SpendTrend: Black Friday Edition 2025

5 December 2025

Welcome to Discovery Bank's Black Friday SpendTrend Dashboard! Our clients made the most of their spending and savings during this exciting shopping event. Below is a summary of their spending behaviour and strategies to maximise value this past Black Friday.

Key insights on Black Friday shopping and payment methods

- Digital payments become the default: Nearly two-thirds of in-store card transactions were made via tap-to-pay on smart devices, while virtual cards accounted for around a third of online spend - showing that secure, app-based digital wallets and virtual cards are now the preferred way for Discovery Bank clients to pay.

- Online spend nearly matches in-store and is growing faster: Online purchases made up 45% of all Black Friday card spend. Online card transactions were also 45% higher than on a typical last Friday of the month, underscoring the ongoing shift towards digital shopping channels.

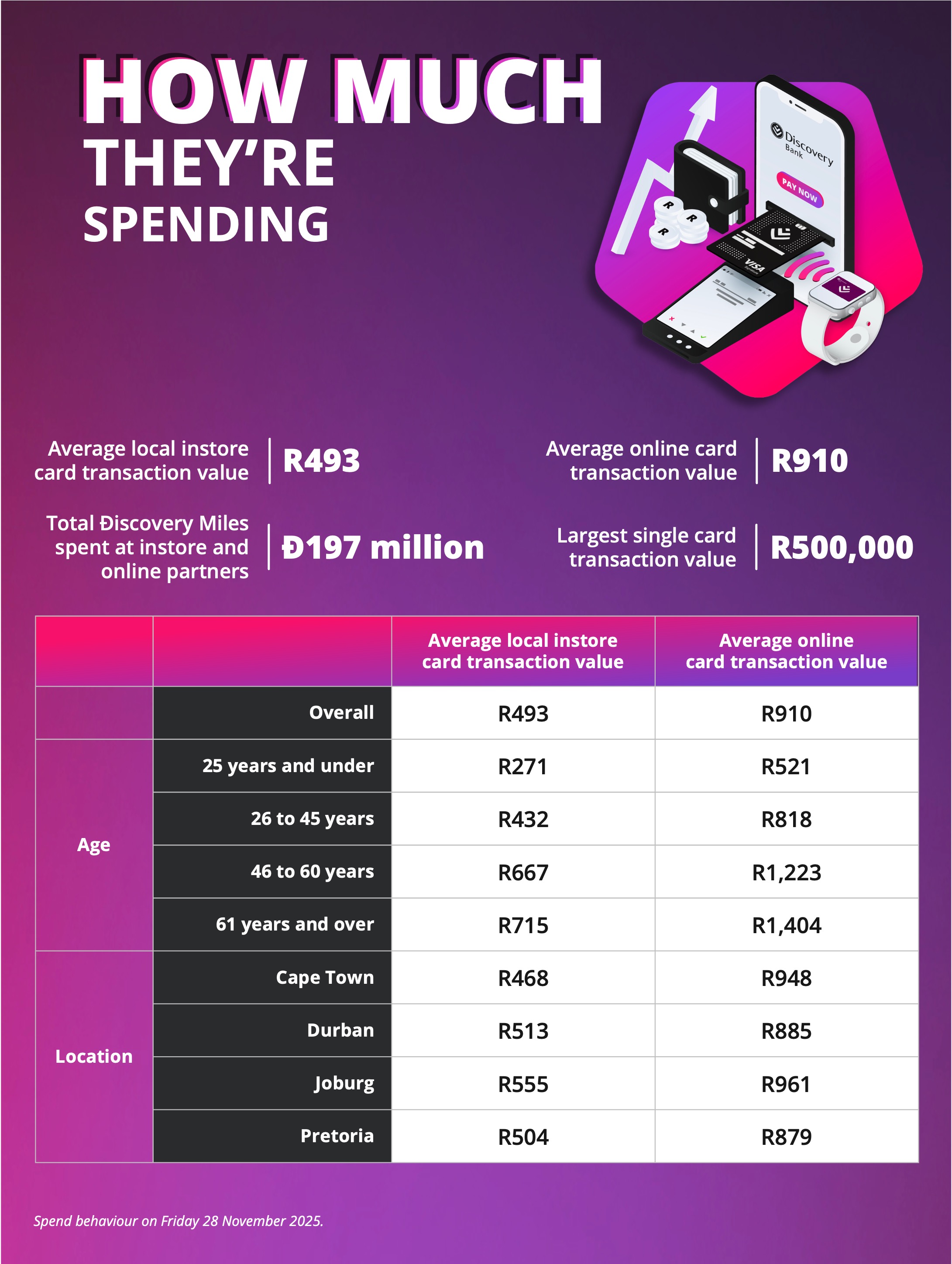

- More transactions, smaller baskets as shoppers stretch budgets: While total spend and transactions rose, average transaction values fell by 3% in-store and 9% online. Clients are breaking purchases into more, smaller baskets and using deals to manage affordability - signalling disciplined, price-sensitive shopping rather than large one-off splurges.

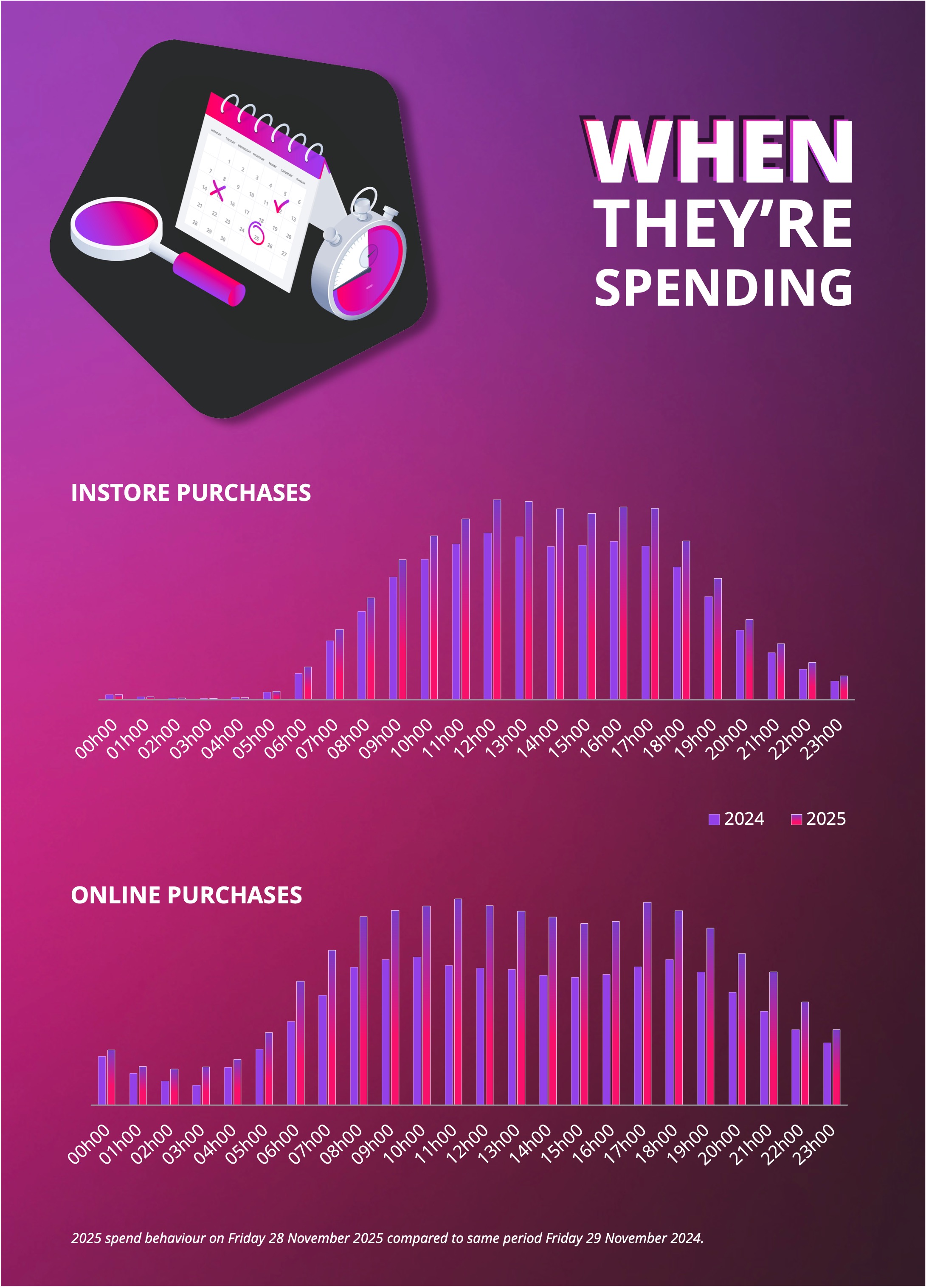

- Black Friday as a "super-charged Payday Friday" - and a 24-hour event: In-store purchase volumes were almost 20% higher than a typical last Friday of the month, cementing Black Friday as the peak payday spending day. Only 54% of online spend happened during traditional store hours (versus 77% in-store), highlighting how clients use online channels around the clock to secure deals and avoid queues.

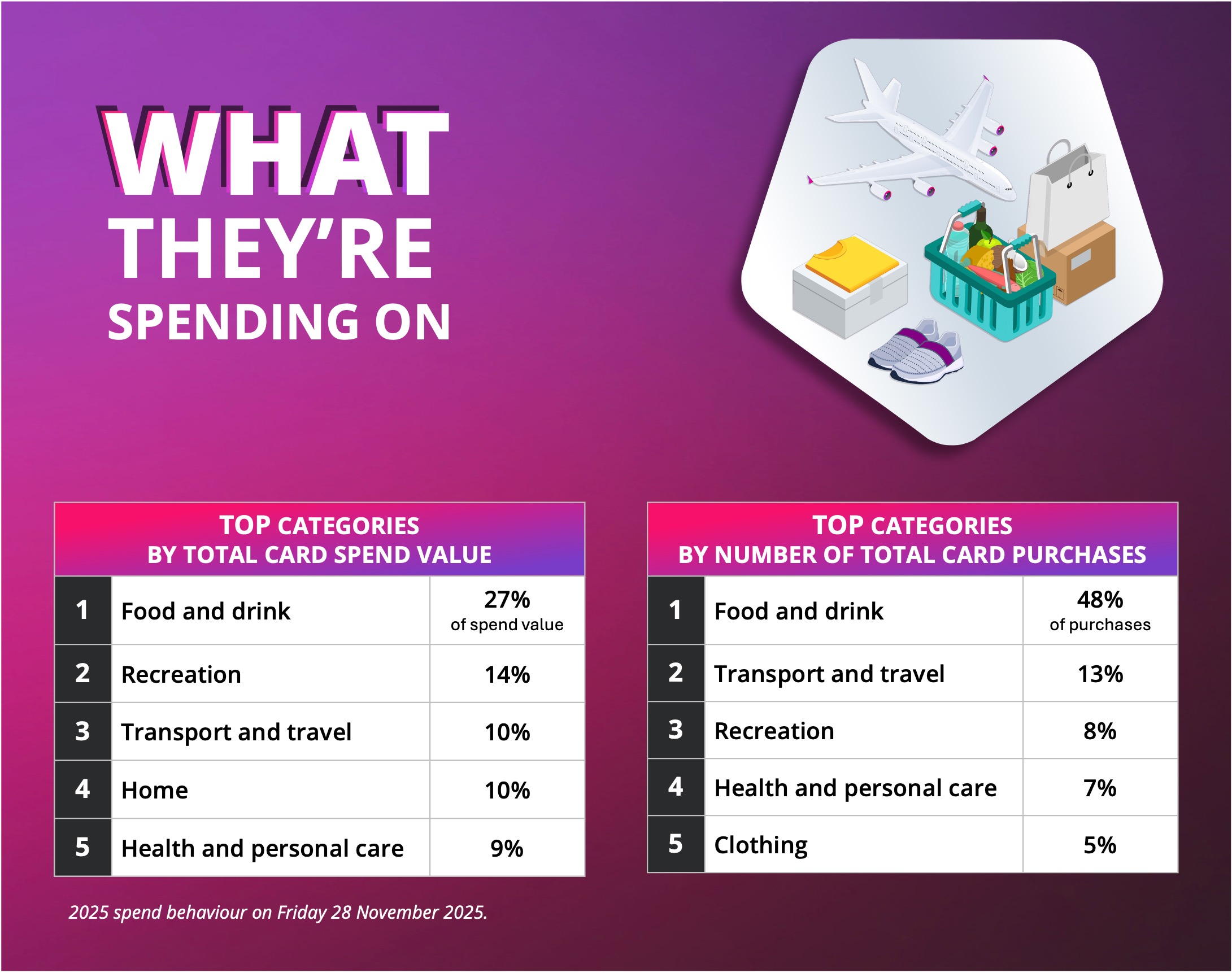

- Everyday and home-focused spending dominates, with clear generational patterns: Food and drink, recreation, and home goods were the top Black Friday spend categories overall. Younger clients (under 25) used Black Friday to refresh their wardrobes, with clothing ranking as their second-highest spend category, while older clients focused more on groceries, home and recreation - consistent with a value-conscious, essentials-first mindset.

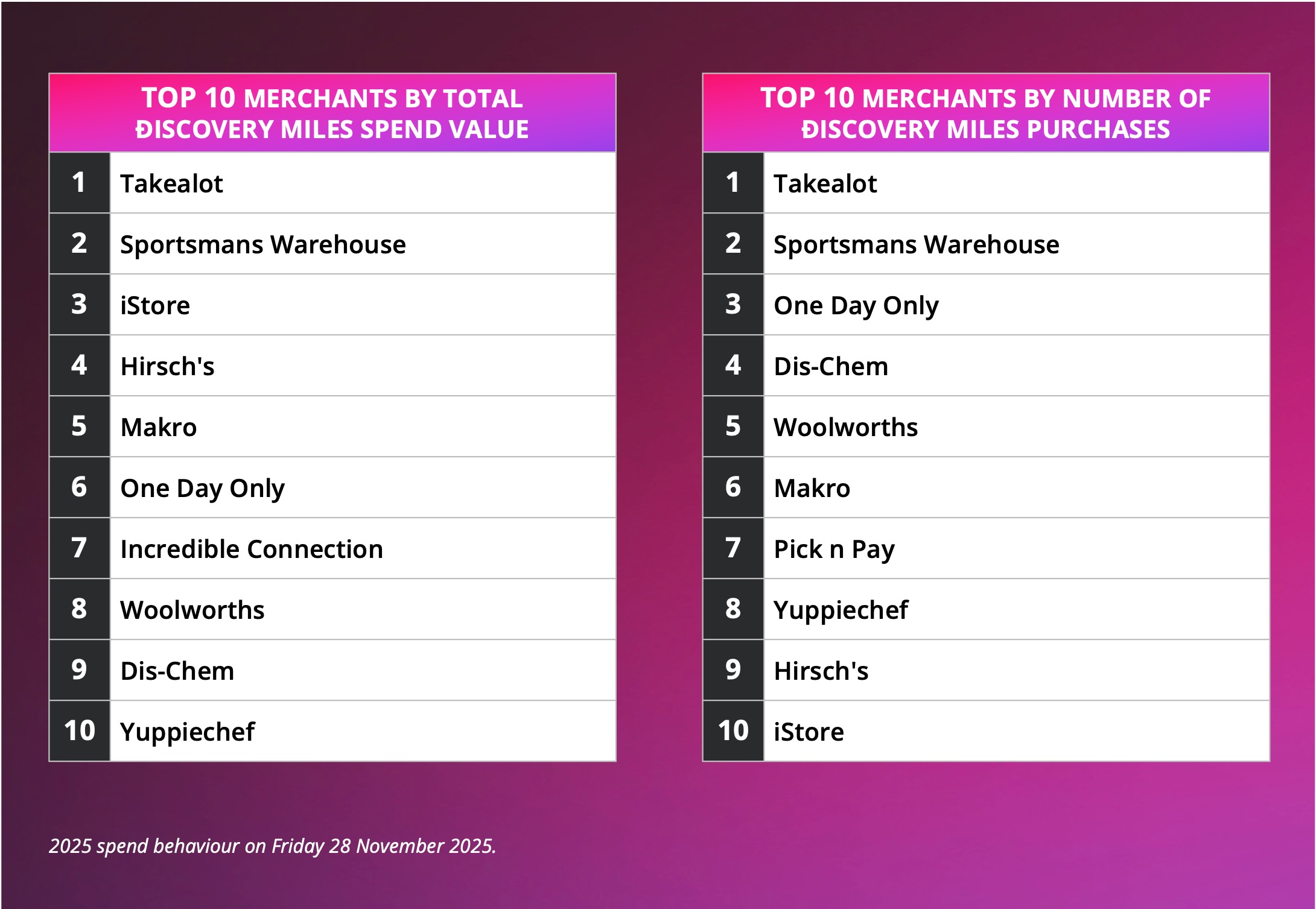

- International marketplaces gain share in a value-conscious market: South African shoppers increasingly mixed local e-commerce platforms with fast-growing international retailers such as Shein and Temu to access competitively priced imported goods, using online channels, digital wallets, virtual cards and rewards to compare, shop and save more effectively.

Black Friday SpendTrend dashboard