Smarter fraud defence for 2026: Meet Discovery Bank's TRUST alert

Fraud isn't just increasing - it's getting smarter. SABRIC (South African Banking Risk Information Centre) reports that most banking fraud in South Africa now stems from social engineering scams, where people are tricked into approving payments themselves.

That's why Discovery Bank introduced TRUST alert - real-time, personalised protection that helps stop fraud before your money moves.

What is the TRUST alert?

TRUST alert is a smart, in-app security feature that checks the risk of every payment - from real-time clearances and EFTs to PayShap - against your usual spending behaviour. No generic warnings. Just alerts that make sense for how you bank.

Real-time risk detection

If a transaction looks unusual, TRUST alert flags it before it's processed. You can review the details and decide whether to proceed or cancel. It doesn't assume fraud - it gives you the insight to act with confidence.

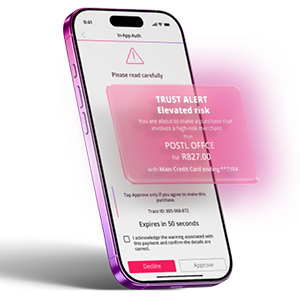

TRUST alert in action

Every payment is assessed in milliseconds. If something feels off, you'll see a clear, easy-to-understand alert in the app explaining why - helping prevent fraud before it hits your account.

With the TRUST alert, you can enjoy:

- Personalised protection

Relevant alerts, based on how you spend - not one-size-fits-all warnings. - Strong protection, within your control

TRUST guides you, without blocking legitimate payments unnecessarily. - Fewer false declines, less friction

Smarter detection means smoother, faster payments. - Superior experience

Early intervention reduces disputes and speeds up support. - Confidence during high-risk periods

From Black Friday deals to the busy festive and New Year shopping season, TRUST alert strengthens your peace of mind when fraud attempts tend to spike.

Why this matters in South Africa

While overall financial crime losses have eased, digital fraud continues to climb - largely driven by scams that manipulate consumers into sharing details or approving transactions. With AI increasingly used by fraudsters, intelligent, personalised protection like TRUST alert is no longer optional - it's essential.

Quick fraud prevention tips: Keeping safe in 2026

- Think before you click

Always verify the sender of SMS, email, WhatsApp or social media messages claiming to be from your bank - especially if they ask for personal details. Legitimate banks won't ask for your PINs or passwords. - Protect your credentials

Never share your PIN, passwords, OTPs or banking details, even if a caller claims to be from your bank. If in doubt, hang up and dial the number on your bank's official website or app. - Secure your device

Use screen locks (PIN/biometrics) and avoid storing passwords in easy-to-access places like notes or screenshots. If your phone is lost or stolen, contact your bank immediately. - Be wary of unusual requests

Scammers often push urgency or fear ("your account will be blocked"). Slow down and verify independently before taking action. - Use bank tools wisely

Set transaction limits on cards you don't use often and consider virtual card controls for added safety. - If something feels off, reach out

Discovery Bank's fraud team is always ready to help. If you suspect fraud or need support, call 011 324 4444.

Stay in control. Stay protected. With the TRUST alert, Discovery Bank clients can transact with confidence, knowing their security adapts to them - smart, seamless, and always one step ahead. Remember: If anything feels off about a transaction, our fraud team is ready to help - just call 011 324 4444.